Quantum Economics

Quantum economics is a fundamental economic theory that unifies the economic theories of Marx Planck, John Maynard Keynes, Ronald Reagan, and Charles Ponzi. It accounts for certain wave-particle dualities that have been observed that cannot be explained using classical economic theory. However, there are many unsolved problems that exist with our current understanding of quantum economics: in particular, quantum economics conflicts with general common sense. Despite this weakness, quantum economics has found many applications in the fields of business and government.

General Description

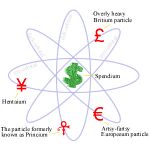

Quantum economics describes the behavior of fundamental particles. Some of these particles are listed below:

- Currençon. The currençon is the fundamental particle that mediates the force of monetism. All money can be quantized into currençons. A currençon can carry a credit charge or a debit charge.

- Politon. The politon is the fundamental particle that mediates the force of politics. Politons come in two flavours: Left-wing and Right-wing.

- Bozon. When a Bozon accelerates, it emits morons and can create a field of ignorance.

In the most common formulation of quantum economics, various properties of a system of economic particles, such as profitability, sexiness, and virtue, are represented as probability functions. These functions are called wavefunctions (short for hand-waving-go-away-I-can’t-explain-it-functions). However, once a measurement or an observation is made of the system, the wave collapses. A “particle” exists as a wave until an observation is made. Until the observation is made, the particle’s position is indeterminate. Only until the observation is made do particle-like behaviors appear. This wave-particle duality is fundamental to quantum economics.

Applications

The above description perhaps can be simplified with an example. A corporation is a collection of currençons and bozons. These particles exist in an uncollapsed probabilistic state. Once an observation (or an audit) is made, then the probability wave collapses into either a profit or a loss. Thus, we have the following sequence:

- Observation.

- ???

- PROFIT!!

How a probability wave collapses into profit is not known with our present day knowledge of quantum economics.

In some cases, an abundance of too many virtual currençons with too many real bozons causes the entire system to collapse into a state of bankruptcy when an observation is made. This economic phenomenon has been investigated by research labs at Enron, Global Crossing, HealthSouth, and WorldCom, despite the fact that the phenomenon is completely well understood.

Experiments in Quantum Economics

In experiments, the theories of quantum economics have been proven to have the same validity as any other theory of economics. Some of the more well known quantum economic theories are outlined below.

Schrödinger’s Cut

Schrödinger’s Cut was a thought experiment proposed by Erwin Schrödinger. Consider a cubicle in which there is no method for an employer to observe the employee contained therein (a so called black box cubicle). An employee is then placed in such a cubicle with access to a corporation’s assets. While the actions of the employee are unmonitored, Schrödinger proposed that the employee existed both in a state of having embezzled and a state of honest work. Only by way of a painful audit can the wavefunction of the employee’s innocence collapse to a single classical economic state (a process called a cut collapse).

Heisenberg’s Uncertainty Principle

Werner Heisenberg provided many contributions to the field of quantum economics, but is most well known for his uncertainty principle. This principle highlights the quantum-level interaction of profitability and virtue. These wavefunctions span two non-commuting dimensions in the economic "Dilbert space" and (as a result of their non-commutative behaviour) affect each other. As a result of this interaction the uncertainty of these two dimensions by way of a product rule (eg. if one is very virtuous, one cannot be very profitable and vice-versa). The uncertainty principle finds best expression in the following mathematical identity:

where v represents virtue, p represents profitability and ħ represents Plank’s constant (the conversion rate between the US dollar and the euro).

See also

External links

Some of the most renowned research labs investigating quantum economics are listed below.

| Featured version: 20 September 2005 | |

| This article has been featured on the main page. — You can vote for or nominate your favourite articles at Uncyclopedia:VFH. | |